Online banking scams are on the rise. And with many of them, you are your best defense.

So, while Chime takes security very seriously — and works diligently to provide a safe mobile and online banking experience — we also believe it’s important to educate our members about the types of scams they may encounter.

Here’s how to recognize online scammers so they can’t take advantage of you and your hard-earned money.

3 red flags for financial scams 🚩

If you’re on social media and see any of the following, there’s a good chance it’s a scam:

- Use of the term “free money”

- Images of large amounts of cash or luxury items

- References to Chime “ambassadors” or “reps”

You should also know that — no matter the platform — Chime will never ask you for your:

- Full Social Security number (though we may request the last four digits)

- Personal information:

- (Account and Routing numbers

Debit or credit card number/information (except last 4) - PIN)

- (Account and Routing numbers

- Money in exchange for services

- Username and password

If an individual asks you for any sensitive information like that, you should cease communications and alert Chime immediately.

How to tell you’re speaking to legitimate Chime employees

While we know we’re awesome, we really wish people would stop impersonating us. But, until we’re able to crack down on every scammer, we’d urge you to double-check who you’re talking to.

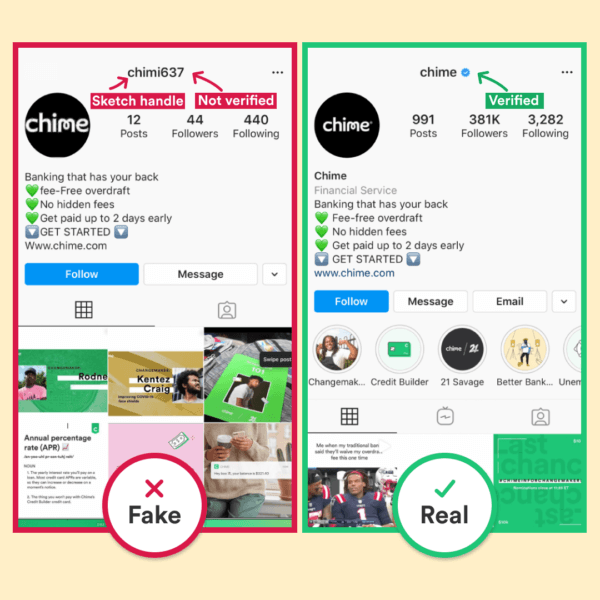

Before communicating with Chime on any social media platform, make sure the account is verified. On Twitter, Facebook, and Instagram, this is signified by a blue checkmark next to our name.

Also: We don’t initiate contact with members via direct message unless they’ve won a sweepstakes or a promotion. If you do win, you’ll hear from Chime’s verified accounts: we don’t have Chime “ambassadors” or “representatives” who speak on our behalf. You’ll know a Chime sweepstakes or promotion is authentic because it will be advertised on our official Instagram account and on television.

As for email, you should always check the address to make sure it ends in @chime.com. If the email address has a different ending, it isn’t from us.

Types of scams to be aware of 👀

We’ve seen a variety of techniques used by individuals falsely claiming to represent Chime. Here are a few you might encounter.

Phone calls 📱

Some scammers call from a fake Chime support number, pretending to be a member services agent. After asking you about recent transactions, they claim your account has been compromised and say they need to mail you a new card. But, before doing so, they ask you to “verify” your account details. Then, once they have that information, they take over your account and drain your funds.

Remember: We won’t ever call you to ask for your personal information.

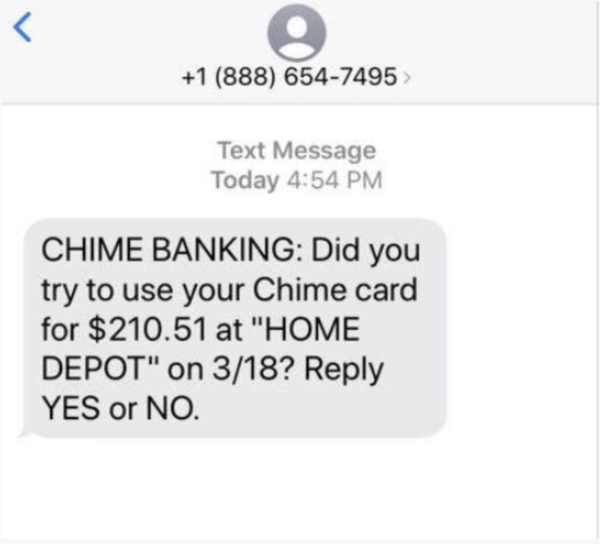

Text messages 📲

Same story, different platform. Scammers pretend they are verifying transactions via text, before ultimately asking you to share your account details.

Pro tip: The scam texts below refer to “Chime Banking.” Note that we’ll never refer to ourselves in a text as Chime Banking.

Cash or money flipping 💸

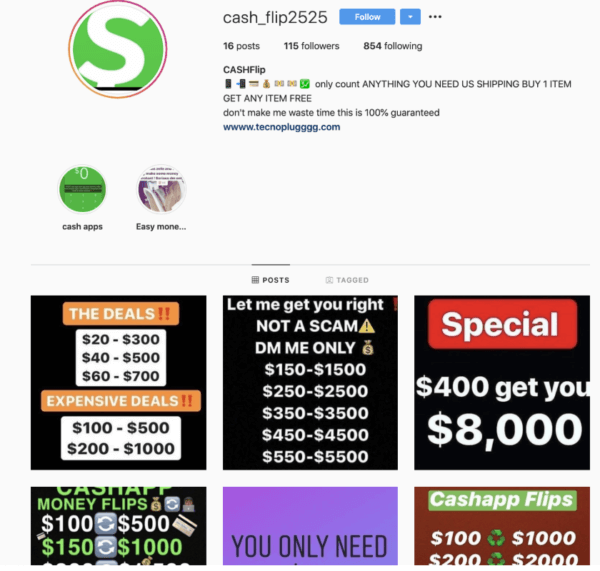

You may have seen promises of “cash flipping” on social media channels such as Instagram, Facebook, and Twitter. You can often spot these posts because they feature images of cash or luxury goods, and are accompanied by a mountain of hashtags like #cashflip, #moneyflip, #cashout, or #fastcash.

These scammers promise they have a “secret” investment strategy — all you have to do is send them some money, and they’ll return it 10 times over.

As TechCrunch reported, “Some variations of money flippers ask for access to an empty bank account, depositing bad checks to make the mark believe they’re getting paid, then withdraw the money before the bank or the customer realizes the checks were counterfeit.”

The bottom line: If it sounds too good to be true, it probably is.

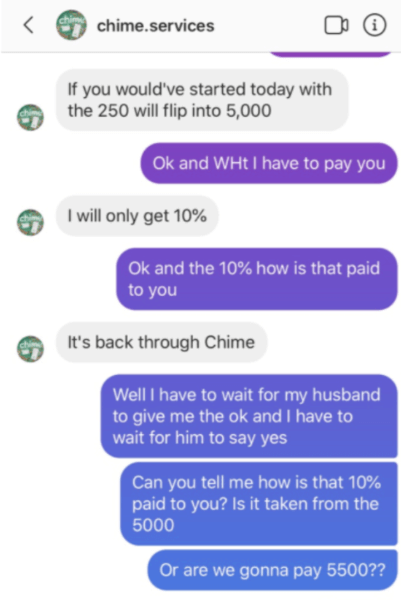

Direct messages 📥

Also found on social media channels, these scammers tag or direct message you, claiming they can “adjust the funds” in your account.

To do so, they may ask for your username and password, card details, transaction history, or even your Social Security number.

REMEMBER: Never share your username and password with anyone — we will never ask for it.

Fake Chime support websites and social media profiles 🖥

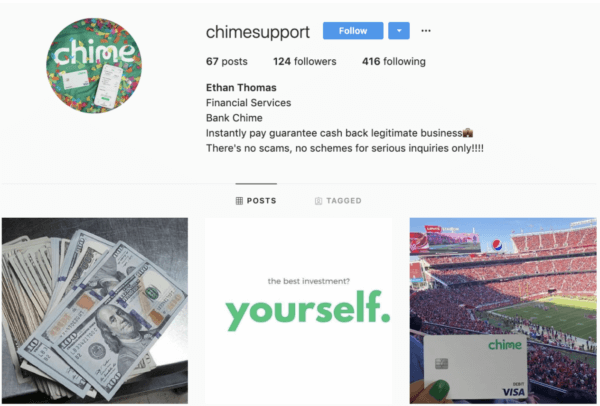

Some particularly ambitious scammers go as far as creating “Chime Support” websites and social media profiles, with the goal of luring members to share their login information and account details.

As we noted above, Chime’s legitimate social media accounts are all verified with a blue checkmark next to our name. If you want to make doubly sure you’re interacting with the real Chime, you can visit our homepage and click the social media icons at the bottom of the page.

How to stay safe and avoid scams 🔒

If scammers are anything, they’re creative — and new types of scams crop up all the time. While we’ve detailed several popular techniques above, this list is by no means exhaustive.

Since we’ll never be able to stay on top of the myriad scams out there, we’d urge you to stay vigilant — and remind you that Chime will never call, email, or text you to ask for personal information or passwords.

Here are a few additional security tips:

- Never write any identifying information, especially your PIN, on your debit card

- Never share your personal information, including your account number, user name, password, Social Security number, birthdate, or address with strangers or on unsecure websites

- Enable push notifications in the Chime app so you’ll immediately be alerted of suspicious activity

- When you’re not planning to use your card, you can even block all debit and Credit Builder card transactions; all it takes is a quick toggle in the Chime app

- Watch out for increased scammer activity during tax season

If ultimately, you think your information has been compromised, you should change your password immediately. And, if you think you’ve been a victim of a scam, you should contact both Chime and the police right away.

What is Chime doing about this?

Although we strive to shut down fake accounts as quickly as possible, new ones continue to appear.

We encourage you to guard your personal information carefully — and if you see a scam, let us know ASAP. You can do so by sending us an email or messaging us directly through any of our verified social media channels.